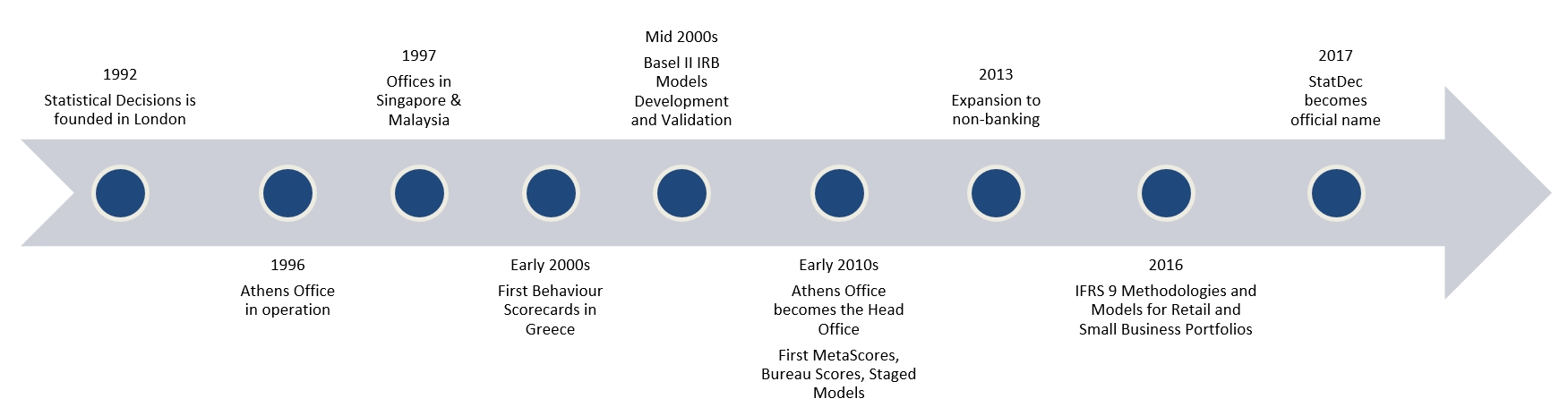

Statistical Decisions was formed in London in 1992.

Its founding partners were staff of Citibank's EMEA Group Credit Office.

The Statistical Decisions Partnership aimed to demonstrate the true effectiveness of Credit Scoring and Data Driven Decisions for managing Retail Portfolios.

Early 1990s were a turbulent period for Banking, as many economies suffered from recession. Mechanical data-driven approaches in the Financial Sector were challenged and calls were made to abandon Credit Scoring.

Yet, the expansion of Retail Banking, the further sophistication in modelling practices and advancements in IT capabilities along with the wide increase of computing power made Credit Scoring as best practice for managing big portfolios.

In the 2000s Statistical Decisions was established as a leading practitioner of Credit Scoring techniques, advancing the efficiency of markets served with tools for optimized, data-driven decision-making processes

In the mid-2000s the new regulatory frameworks on Capital Requirement (Basel II) set Credit Scoring at the centre of managing and estimating Credit Risk for Retail portfolios. Statistical Decisions’ Credit Score development techniques and documentation were directly acknowledged as compliant, exceeding supervisory requirements.

By 2010s, the Athens office, established in 1996, became the main modelling hub of the company, advancing the local and regional market knowledge on Credit Scorecard development and use, Retail Banking best practices and setting up a reference point for professionalism and service.

In 2016, the IFRS 9 Standard on Provisions introduced the requirement of using ‘best estimates’ in calculating provisions, i.e. a probabilistic approach. Again, Credit Scorecards were considered the optimal tool for risk classification and deriving best estimates of default rates. StatDec, with long experience in developing and maintaining Credit Scores, supported Financial Institutions to use Credit Scorecards, along with other Model types, in this area as well.

In 2017, with respect to its heritage, the company adopted the name many of the clients and staff unofficially used, and Statistical Decisions was naturally renamed to StatDec. The official name is still occasionally used.

In 2017, with respect to its heritage, the company adopted the name many of the clients and staff unofficially used, and Statistical Decisions was naturally renamed to StatDec. The official name is still occasionally used.

By the 2020s the availability and use of data in making decisions and managing portfolios had expanded beyond banking, into retail merchants, energy providers, telecommunications and other sectors. With over 30 years of experience in processing massive datasets and developing models, StatDec brings this expertise to new areas and supports businesses in making informed decisions based on state-of-the-art modelling techniques such as Machine Learning Models for Transactional and Behavioural Models.