CRD IRB for Retail Portfolios

We provide support for the developmnent and implementation of the Internal Ratings Based Approach (IRB) which allows a Financial Institution to use its own estimates of risk for the calculation of Capital Requirements and therefore benefit from improved risk management practices.

StatDec's Approach is based on the close cooperation between the Consultant and the Client to ensure successful implementation. This is achieved by establishing clear reporting channels, regular client-consultant review meetings and a thorough verification process.

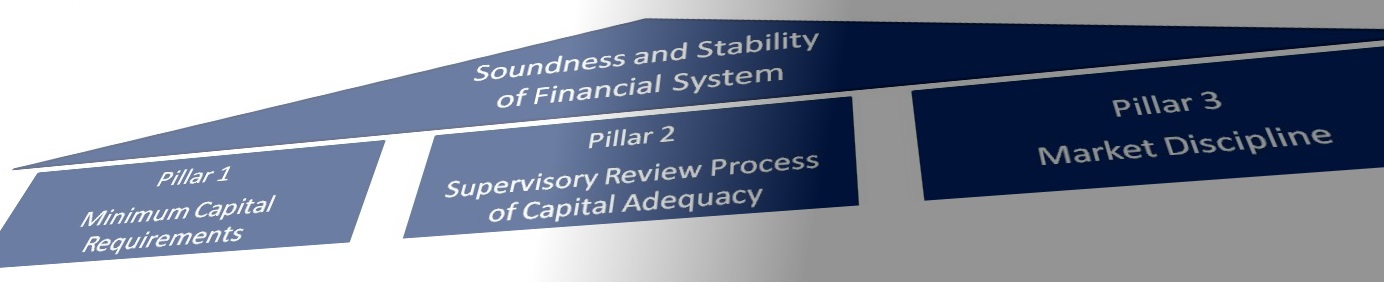

The services offered are compliant with the BCBS Framework, the European Credit Requirements Directive (CRD), the European Capital Requirements Regulation (CRR), the Committee of European Banking Authorities (EBA) as well as the Acts and guidance documentation of local Supervisors were necessary.

IFRS 9

The changes introduced by IFRS 9 brings in a parallel course the two frameworks (Basel & IFRS) in expected loss estimation for retail portfolios. StatDec's long expertise in data analysis and modelling for Retail Portfolios provide Financial Institutions seeking compliance with the framework with a reliable partner.

Why StatDec?

StatDec offers customized services to Banks tha seek to achieve compliance with the IFRS9 Standard and CRD IRB framework.

StatDec has been assisting Banks on IRB compliancy projects since 2006 and for implementation of IFRS 9 Standard since 2016. Models developed by StatDec, even for irrelevant projects, are regularly used for Provisions and Capital Requirements. Models developed by StatDec when audited have been found compliant in all occasions.

Consultative Support

- Specification of data requirements

- Design of development and implementation methodology

- Design of Monitoring and Validation Process and Reports

- Stress Testing methodology and support

Technical Support

- Implementation of methodologies for PD, EAD and LGD

- Lifetime Estimates for Risk Components

- Macroeconomic Models for Risk Components

- Steering Tables (term structure)

- Recalibration of existing models to Basel II definition (Application, Risk Grades, Behaviour Scores).

- Development of new models or strategies for PD for segments not covered by existing models

- Development of LGD and EAD component models

- Pool Design

- LGD, PD and EAD Risk Component Estimations

- Validation Framework

- Capital Requirements Calculation

- Stress Testing analysis (scenario, sensitivity)

- Expected Credit Loss (ECL) and Lifetime Credit Loss estimation (LCL) for IFRS 9 compliance

- Strong Documentation

- Scripts for implementation