Scoring - A Decision System

A scorecard is a statistically based model developed on data of the historical performance of the portfolio.

The key benefit of classifying customers based on a statistically derived scorecard is that it provides the client with an objective numerical prediction of their future behaviour.

- Outputs are objective, consistent and repeatable – it always gives the same result.

- It allows the implementation of strategies in the decision process

- It is scalable to handle peaks in application volumes and therefore cost effective

- Performance of the scorecard, each characteristic within the scorecard and the credit decision is measurable against benchmarks

- The scorecard and decision can be improved. By monitoring performance, the model can be adjusted and the decision strategy controlled. A feedback loop is in place

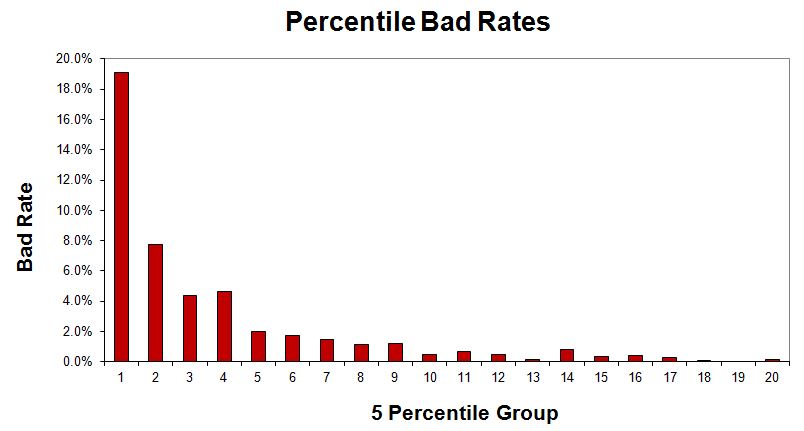

- It produces a continuous scale of risk so that approval rate can be easily adjusted to approve the next least risky applicants or reject the next highest risk applications

A Credit Scoring Project

StatDec's scoring services may include the whole project cycle from project design and data quality analysis to development, implementation, validation and on-going maintenance but can also support parts of it.

Scoring projects generally have the following forms:

Application scores are used to support credit imitation process, i.e. when an application from a customer takes place.

Application Scorecards can be based on information collected from the Application form, in the most basic form. Usually Application Scorecards are augmented by credit bureau reports and information from any existing relationship with the applicant. In general these scores are used to predict the probability of the applicant defaulting and are used to underwrite a credit proposal.

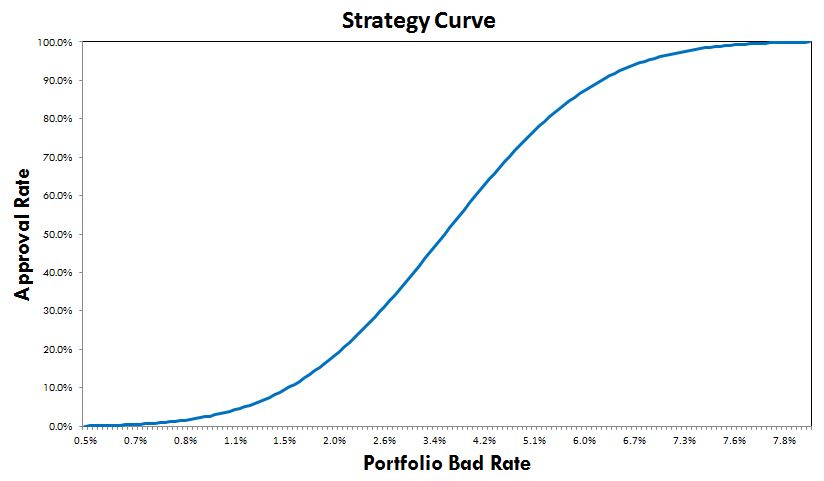

With the use of a cut-off table a strategy curve can be produced to facilitate credit process and help answer these questions:

- With a 10% increase in the approval rate what will be the effect on the loss rate?

- Required to manage to a given loss rate what should the approval rate be?

- If the loss rate is low and therefore we can approve more applicants, how many and which of those that we would have previously rejected should we now approve?

- If the loss rate is too high and we need to reject more, how many and which of those that we currently approve should we now reject?

Behaviour scores are developed using the information on the account activity of an existing customer. Where customers have more than one account it is possible to develop an overall customer score using information from all accounts.

Segmentation based on behaviour scores allow for clear, objective and statistically optimal classification.

Due to their strong predictive power, their many uses and their easy manageability, they are placed at the centre of most financial institution’s decision making functions.

Most common areas of application include:

- Key driver for risk segmentation in Collections strategies

- Provisioning (IFRS 9)

- Basel Capital Requirements - Model Design for Risk Components (PD, LGD)

- Limit Management

- Renewals/Cross-Selling

- Credit Assessment for existing clients

- Marketing Campaigns

- Portfolio quality tracking

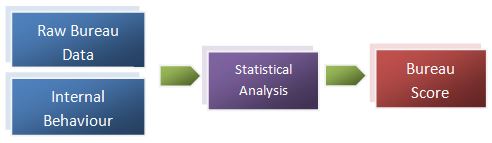

Customised Bureau Scores based on raw credit bureau data.

Customised Bureau Scores are considered best practice when compared to externally provided services (when available) as they:

- are customized to specific businesses/portfolios and thus can outperform external generic scores

- can be validated to its component level and adjusted when needed

- provide competitive advantage in the market (not using the same info as everybody else)

- are cost effective, as usually raw data are less expensive than bureau score services

- are optimal to the decision point of reference (e.g. application point)

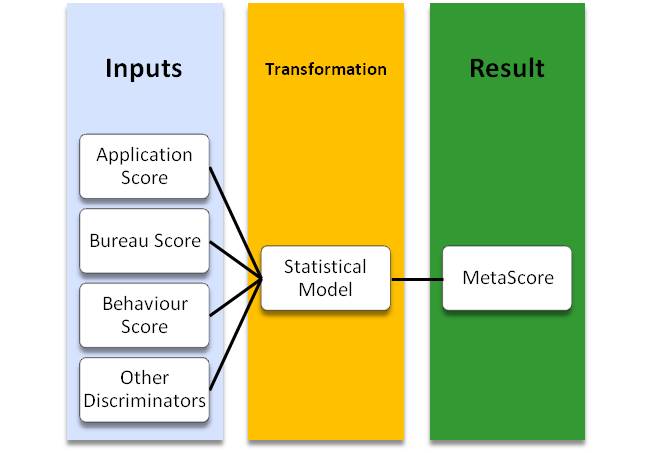

StatDec's solution for optimal decisions in a simplified layout in multi-scoring environments.

A final layer, where risk information brought by different models are incorporated into a final model.

MetaScores have significant advantages over established approaches followed in multi-scoring environments:

- A single measure of risk level

- Quantifies off-setting risk factors by considering information sources together not individually

- The approval process can be simplified with the removal of multiple stages

- Manageable output, with one final score distribution

- Using a MetaScore is a process that can be validated and bench-marked vs. any other practices (compared to a matrix).

Our MetaScore approach has had successful implementation in multiple organizations with considerable gains in decision process efficiency and effectiveness in terms of the approval rate.